As 2022 draws to a close, I find myself reflecting on yet another record year of real estate sales. I exceeded $750,000,000 in lifetime sales, set 14 new price records and sold out several new construction developments in less than an hour. I rode a Peloton bike over 3,000 miles and coached championship winning flag and tackle football teams. In-between all of that work and fun I’ve also been following a few trends within the Nashville real estate market that may give us some true insight into what 2023 may bring for buyers and sellers.

As 2022 draws to a close, I find myself reflecting on yet another record year of real estate sales. I exceeded $750,000,000 in lifetime sales, set 14 new price records and sold out several new construction developments in less than an hour. I rode a Peloton bike over 3,000 miles and coached championship winning flag and tackle football teams. In-between all of that work and fun I’ve also been following a few trends within the Nashville real estate market that may give us some true insight into what 2023 may bring for buyers and sellers.

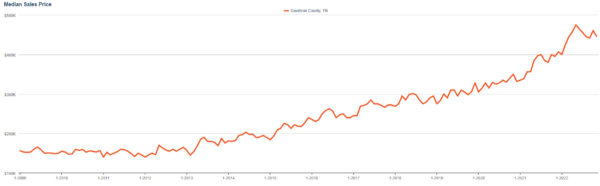

Nashville Real Estate Price Trend Analysis

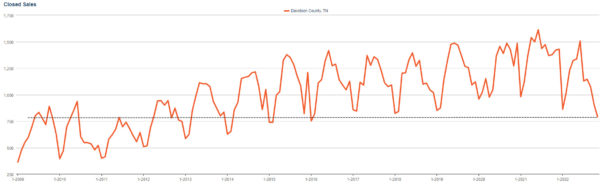

Let’s first talk about the biggest headline of the year: price. Median prices exceeded all expectations blasting through $475,000 in June of this year. It was a meteoric rise over $396,500 in 2021 and $325,000 in 2020. That’s a 46% increase in price over just 24 months. At no other time over the last 3 decades of data is that much of a increase found. We all know why this happened. Artificially low interest rates fueled purchases in an already undersupplied marketplace, but we’ll talk about supply later.

Nashville Mortgage Rate Trend Analysis

We accept that supply and demand move the price needle within the Nashville real estate market, but many forget just how much the demand side of the equation can be affected by mortgage interest rates. I’d make the argument that mortgage rates affect the demand side more than scarcity, but I do agree that those can be opposing forces. 16 years ago one can see that mortgage rates rose close to 7% prior to the Great Recession. Looking at the data at the time, we can extrapolate that once mortgage rates crossed 6.5%, given median household income ($62,254) and median price ($191,420), that most buying activity stopped in mid-2006.

Realigning for inflation since 2006 (47.67% meaning today’s prices are 1.48 times higher than 2006), we can attempt to recreate this math for the mortgage rate at which most buying activity should stop in 2022 or 2023. Given median household income in December 2022 of $74,832 and plugging in the peak median price of $475,000 we get a interest rate of approximately 5.09%. This means we have already crossed the equilibrium threshold. One must conclude that should interest rates remain above 5.09%, Nashville home prices will continue to fall below $475,000 until equilibrium is met.

Realigning for inflation since 2006 (47.67% meaning today’s prices are 1.48 times higher than 2006), we can attempt to recreate this math for the mortgage rate at which most buying activity should stop in 2022 or 2023. Given median household income in December 2022 of $74,832 and plugging in the peak median price of $475,000 we get a interest rate of approximately 5.09%. This means we have already crossed the equilibrium threshold. One must conclude that should interest rates remain above 5.09%, Nashville home prices will continue to fall below $475,000 until equilibrium is met.

What does the math show at today’s interest rate? Using the same median household income of $74,832 and today’s 30 year mortgage rate of 5.875% tells us the current equilibrium point is approximately $407,500. Ironically this is incredibly close to the average price achieved in December 2021. This should hold true unless the average median income goes up or the supply of homes is greatly reduced, both of which are unlikely.

What does the math show at today’s interest rate? Using the same median household income of $74,832 and today’s 30 year mortgage rate of 5.875% tells us the current equilibrium point is approximately $407,500. Ironically this is incredibly close to the average price achieved in December 2021. This should hold true unless the average median income goes up or the supply of homes is greatly reduced, both of which are unlikely.

What Will Mortgage Interest Rates be in 2023?

I’d argue that it’s highly likely Nashville mortgage interest rates will continue to fall. In fact, given the current 10 year Treasury hovering around 3.45, we might see interest rates much closer to those of 2010 – a year when the rates dipped into and stayed into the 4’s for the majority of the year. This doesn’t align perfectly with the more common {10 year Treasury + 1.8 = the 30 year mortgage rate in 2 weeks} math that we are accustomed to seeing, but it does align with a banking system that will become increasingly desperate for primary residence loan deal flow.

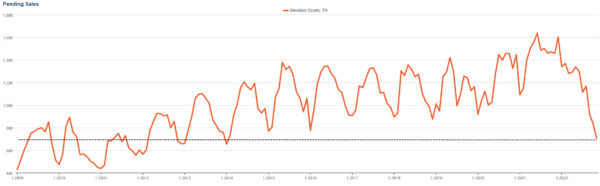

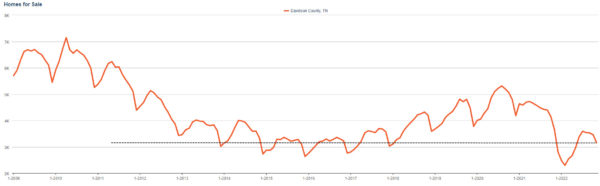

What about the Nashville Housing Supply?

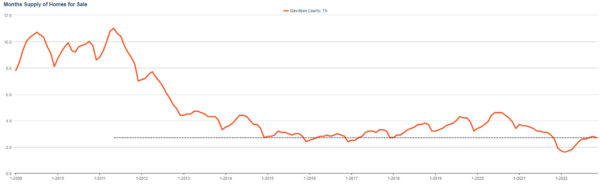

Let’s first agree that the entire country has been underbuilt since the Great Recession. Builders, developers and banks all pulled back as compared to the decade prior to the Great Recession. What’s more interesting to me is we roughly have the same number of homes for sale now as we did in November 2016 (3,223) before inventory levels began in inch up over a 5 year period. That entire 5 years’ worth of inventory growth was wiped out in the matter of 1.5 years and fell to an all-time low this century post pandemic shutdowns. This in turn pushed the months of housing supply below 2 months for the first time in measurable history.

Most developers and builders are already planning to slash their new home starts in 2023, but I do think we may see a significant uptick in inventory next year due to the FUD factor – fear, uncertainty and doubt. We humans are an emotional lot and many times we are influenced to sell something when we become fearful of the future. We are fast approaching an economic recession and that fact alone will stir deep feelings within many. Add to that the continuing loss of stock value, retirement value and a jobs market that will significantly tighten and you have a recipe for the average Joe to freak out. It’s my opinion that this FUD factor will cause many to list their homes and for some to accept lower than market values in order to sell.

Most developers and builders are already planning to slash their new home starts in 2023, but I do think we may see a significant uptick in inventory next year due to the FUD factor – fear, uncertainty and doubt. We humans are an emotional lot and many times we are influenced to sell something when we become fearful of the future. We are fast approaching an economic recession and that fact alone will stir deep feelings within many. Add to that the continuing loss of stock value, retirement value and a jobs market that will significantly tighten and you have a recipe for the average Joe to freak out. It’s my opinion that this FUD factor will cause many to list their homes and for some to accept lower than market values in order to sell.

What Happens with Nashville Home Prices in 2023

The math says Nashville homes prices should remain relatively flat. The more desirable areas may even appreciate a little while the less desirable areas depreciate a little. However, when I consider the FUD factor, I do think the less desirable areas will depreciate more than the math proves. This negative price action will bleed into the more desirable areas lowering my expectation from a little appreciation to flat. This is the falling tide theory. This leads me to conclude that the overall market will show price depreciation in 2023. How much? Well it’s difficult to say with any degree of certainly what value to assign to the FUD factor, but I’m going to assume a standard deviation factor of 1.12 (just an educated guess). This would predict the average median price falls 6.32% in 2023.

I think it’s important to note that my predictive analysis is rather static. You’d have to take into account hundreds of other factors in order to make a perfectly accurate prediction. Only Jerome Powell may have the real answer. However, I always find value in working through the examples above and I hope that you do to. Happy Holidays and see you soon!