Freddie Mac released the results of its Primary Mortgage Market Survey last week in which the 30-year fixed-rate mortgage (FRM) averaged 4.78 percent with an average 0.7 points for the week ending November 25, 2009, down from the prior week when it averaged 4.83 percent. Last year at this time, the 30-year fixed rate mortgage averaged 5.97 percent. The 30-year has not been this low since the week ending April 30, 2009, when mortgage rates also averaged 4.78 percent.

Freddie Mac released the results of its Primary Mortgage Market Survey last week in which the 30-year fixed-rate mortgage (FRM) averaged 4.78 percent with an average 0.7 points for the week ending November 25, 2009, down from the prior week when it averaged 4.83 percent. Last year at this time, the 30-year fixed rate mortgage averaged 5.97 percent. The 30-year has not been this low since the week ending April 30, 2009, when mortgage rates also averaged 4.78 percent.

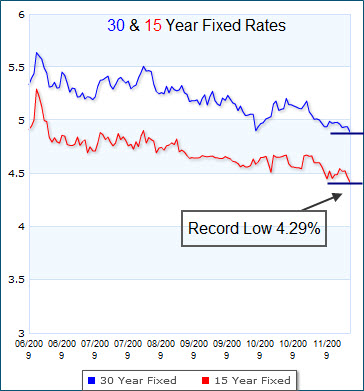

The 15-year fixed rate mortgage last week averaged 4.29 percent with an average 0.6 points, down from the previous week when it averaged 4.32 percent. A year ago at this time, the 15-year fixed rate mortgage averaged 5.74 percent. The 15-year fixed rate mortgage has never been this low since Freddie Mac started tracking it in 1991.

“Long-term mortgage rates eased for the fourth consecutive week to record levels,” said Frank Nothaft, Freddie Mac’s chief economist.” Interest rates for 30-year fixed mortgage loans tied an all-time record low while both 15-year fixed mortgages and 5-year ARMs broke their corresponding records. Interest rates for 30-year fixed-rate loans are currently 0.8 percentage points below this year’s peak set in mid-June, which shaves roughly $100 off the monthly payments on a $200,000 mortgage.

“Nashville house prices are slowly beginning to firm now. For instance, annual house price declines slowed for the sixth consecutive month in September, down only 3 percent, and represented the smallest decline since February 2008, according the Federal Housing Finance Agency’s purchase-only house price index.”