While Freddie Mac’s weekly report on mortgage rates showed the 30-year rate dipping slightly below 5 percent, these rates did not budge in Bankrate.com’s weekly survey of large lenders.

While Freddie Mac’s weekly report on mortgage rates showed the 30-year rate dipping slightly below 5 percent, these rates did not budge in Bankrate.com’s weekly survey of large lenders.

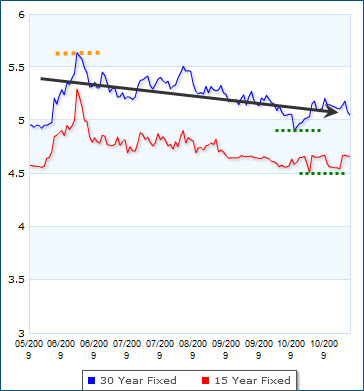

The benchmark 30-year, fixed-rate mortgage remained unchanged at 5.35 percent, according to Bankrate.com’s weekly national survey. The benchmark 15-year, fixed-rate mortgage dipped 2 basis points, to 4.72 percent. The benchmark 5/1 adjustable-rate mortgage remained unchanged, at 4.64 percent.

The mortgages in last week’s survey had an average total of 0.31 discount and origination points. One year ago, the mortgage index was 6.44 percent; four weeks ago, it was 5.22 percent.

As you can see from the graph, the trend line is sloping slightly downward over the past 6 months, but how long can mortgage rates remain low? I have spoken about this before, but it bears repeating. These mortgage rates are being held artificially low and the Fed simply cannot afford to manufacture these rates for very much longer.

A successful local developer, one who tracks and understands the market forces, explains it clearly: “Remember, Obama wants to be known as being fiscally responsible like Clinton. At some point, probably March or April, there will be no more artificial sweetener (stimulus and lax GSE underwriting). And even before then, the Fed will have to at least reduce its purchases of MBS (mortgage backed securities), which is artificially reducing mortgage rates. The question is whether or not employment/spending can somehow replace all this intervention. I haven’t seen any consensus among economists that it can.”

Along the same lines, the branch manager of Bank of America Mortgage concedes that, “Certainly the Fed will have to curtail the purchase of MBS by mid 2010. The current administration is going to have to pull back these 11th hour bulk purchases and allow the natural market forces to take over. Congress is going to wake up one day and turn off this leaking faucet.”

What does all of this mean to you?

Great question. It means that the next 4-5 months might be the last time to secure a conventional or FHA mortgage in the 5 percent range. It means that when mortgage rates begin to reset, there is a good likelihood that those rates will rise significantly in a relatively short amount of time. It also means that if you are on an adjustable rate mortgage, you might be in for a world of hurt if you do not refinance.