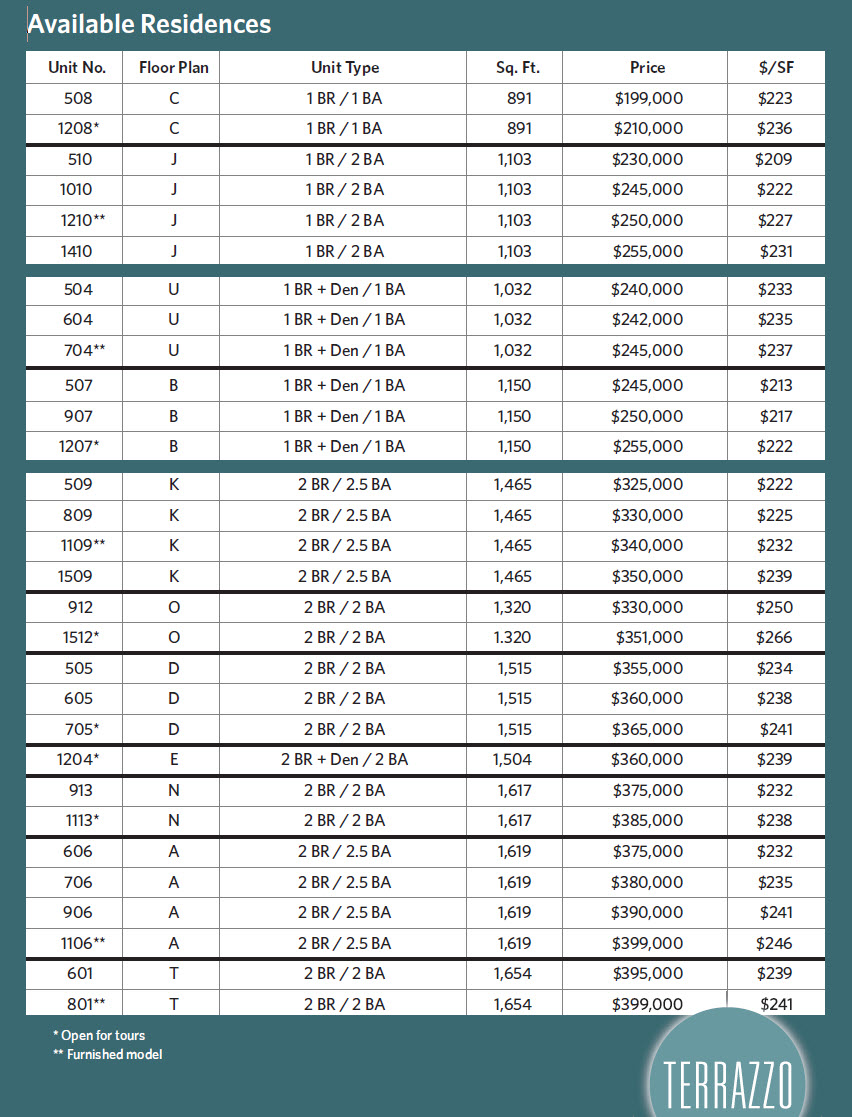

In a move that has both shocked some people and delighted others, the sellers of the Terrazzo condos in Nashville have decided to extended the auction prices. Although these prices do not currently appear on the MLS, they are available on the Terrazzo’s website and were direct emailed to all of the buyers and agents who participated in last Saturday’s auction.

A lot of people have asked if these sales will bring the entire Nashville condo market down to $225-230/ft prices and are worried that their investments in the surrounding buildings are now irrevocably harmed. I do not think that this is the case, just as it was not the case when the Adelicia gave the last 20 buyers in that project a 25% discount to close out the building out 18 months ago.

However, make no mistake about it, this drastic price drop will have a net present effect on all of the surrounding condos. That effect will diminish the further you travel away from the building, but it will still be felt for the short term. I would expect that very few condo developers will lower their listed prices as a result of the Terrazzo auction and subsequent re-pricing, but I do believe that they will become more flexible in negotiating their future deals.

Golden condo buying advice

Now is an excellent time to be a condo buyer in any building. Take your time to look around at all of the options to see which best fits your lifestyle, design aesthetic, preferred area of Nashville and investment goals. Each building offers something a little bit different and the end prices will reflect that fact.

After you have narrowed your choices, research the recent and historic comparables in that particular building in order to formulate a realistic offer, an offer that will insulate you from the eventual condo price floor that should be reached within 12-16 months (my opinion). If you plan on owning this condo for at least that period of time, I cannot see a way to get harmed during the resale process unless you have not followed the above advice.

I have given this condo buying advice before, but it bears repeating: “Be fearful when others are greedy, and be greedy when others are fearful.” Build in the down times and prosper when the rest catch up.

Contact Grant for private condo consultation √

Selling your Nashville condo is not the only way to exit. You could also lease your condo. For those of you who doubt the viability of leasing, I refer you to Summit Property Management, the leader in this rental market.

See all condos for sale in The Terrazzo

November 24, 2009, 9:26 pm

So would you concur that the Auction Method of Marketing established a current market value for a given day in the Nashville Condominium Market and in your humble opinion was the Terrazo Auction a success.?

November 24, 2009, 10:01 pm

I love you auctioneer guys and your questions! Yes, I would say that the auction did establish a market value for a 1 day 27 condo sale in a class A building located in a Class C+ location. I believe that the sale was a success from the standpoint of bringing more awareness to the Terrazzo as well as to the downtown condo market as a whole. However, I am not convinced that the future market rate is $233/ft even though they have priced an additional 30 condos at this auction rate. You must take into account that this is a semi-distressed sale from a venture fund who has several cash call coming in the next several months. This is an effort to stave off the bank loans and establish a more liquid position for those future dates with destiny.

November 25, 2009, 2:26 pm

Grant, is your “golden condo buying advice” directed toward investors? I am a first-time home buyer looking to purchase a condo in the downtown area. My lender just told me it was going to be very difficult to find a building I can get into now and be able to sell to anyone other than a cash buyer. The lender said I need to look at buildings that are at least 70% sold and a minimum of 51% owner-occupied. Is there such a thing in the downtown market?

November 25, 2009, 8:07 pm

Grant, is your “golden condo buying advice” directed toward investors? I am a first-time home buyer looking to purchase a condo in the downtown area. My lender just told me it was going to be very difficult to find a building I can get into now and be able to sell to anyone other than a cash buyer. The lender said I need to look at buildings that are at least 70% sold and a minimum of 51% owner-occupied. Is there such a thing in the downtown market?

November 25, 2009, 7:05 pm

My advice is for anyone and everyone who is considering a condo purchase. It is my opinion that primary purchase buyers should always keep a watchful eye on the bottom line as well as probable future values. I am not sure who your lender is, but yes, there are buildings that meet that criteria: Encore, Adelicia, Viridian and shortly Terrazzo. While I somewhat disagree in small part with the 70% sold, I do agree that you never want to buy into a building that is less than 51% owner occupied. All of the aforementioned condo developments have leasing restrictions in place to only allow 20-25% of the building to be leased.

The part that irks me is your lender's statement that you won't be able to sell in the future to anyone other than a cash buyer. That is just incorrect. All of the above buildings are not going to be a problem and within 12-18 months you can probably add the Rhythm and Icon to that list. Let me suggest that you speak with someone at CityLife, Bank of America or Starkey who finances condos for a living prior to making a decision on where to live.

Please direct your lender to this website, it will be a great way to get their bearings in the downtown condo market.

November 25, 2009, 9:10 pm

PotentialCondoBuyer,

I agree with Grant. It doesn't sound like your lender really understands the nuances of the Nashville condo market. As Grant noted, Adelicia, Encore and the Viridian strictly limit leasing and are the safest bets, but that's really mixing apples and oranges.

At the top end, you have Adelicia, Terrazzo, The West End, and Belle Meade Court. Of these, only Adelicia is sold out and the appeal and stability of that project will run you more than $350/sf. Terrazzo also restricts leasing and is now almost 40% sold. But for the moment you can pick up a unit there for only $230-$240/sf. Neither Belle Meade Court nor The West End restrict leasing and both still ask much more than $300/sf. The West End will undoubtedy auction units for $200/sf or less but regardless I think this project and Belle Meade Court (both less than 10% sold) are at risk of foreclosure and face much more uncertainty as to when they will stabilize.

At the lower end, Viridian (soldout) and Encore (80% sold) both restrict leasing and currently command prices of between $250 & $270/sf and the finishes in these units are generally builder grade, designed for entry level buyers. But these prices will probably come down some in response to all the recent auction fever, especially considering the weak financial condition of the Encore developers. Icon, Rhythm and Velocity, also new entry level condos, seem severely overpriced to me (at $300+/sf) considering they're only 40%, 25% & 10% closed, respectively. And, like Bristol West End, Enclave, Bristol on Broadway and 5th & Main, none of these projects have bylaw restrictions to limit leasing. This not only threatens future compliance with conforming mortgage programs, it also increases the likelihood that a swarm of renters will diminish the appeal of these projects to owner occupants at some point. Who wants to pay $300+/sf to live amidst a bunch of hellraising renters re-living their college yrs and beating up the building?

November 25, 2009, 9:27 pm

Had some technical difficulties before finishing…anyhow, your lender is correct to flag the need to focus on owner occupancy and the related need for your future buyer to access conforming loans a few years from now. Current occupancy and bylaw rental restrictions are key to covering this base. Though while buying into soldout rental restricted projects may be the safest option, you might find a better bargain in buildings like Terrazzo or Encore (if you can negotiate a price below $250/sf).

November 26, 2009, 9:46 am

Thank you Falcon2, you are absolutely right on the money. There is a point at which risk and price intersect to create the “best deal”. In my opinion, that opportunity is currently available in the Encore and the Terrazzo. Now that we have narrowed the safe deal choices down to those two buildings, you just need to decide whether you prefer to be in the Gulch or closer to traditional downtown and what that has to offer.

December 2, 2009, 2:29 pm

For the sake of clarity about the West End, I do think that there is a lease restriction in the by-laws. I didn't read them closely, but it appears that you cannot lease until the building is 100% sold (Section 12.1).

December 2, 2009, 3:38 pm

Good point. Yes, there can be no leasing for some time at the West End and there are also onerous right of first refusal conditions in that same section of the bylaws. Absent a release from these conditions this could make it very difficult for owners to sell their units and, oddly, owners are also agreeing to be assessed for their share of any unit purchase that the HOA decides it may want to make. I wonder how many prospective bidders will even read these provisions.

December 2, 2009, 4:29 pm

I assume that most investors (who know what they are doing) will read them. I do think that a lot of first time purchasers (like myself) will not.

All in all, given the fairly creative/strange/restrictive/open to abuse by-laws, the strange financing arrangements (Compass won't do loan commitments, only pre-qualifications – which means bidders are risking 5% of the purchase price with no way to assure financing), and the strange lack of information flow on reserves and which units are absolute, I am getting pretty nervous about bidding at this auction.

Any potential buyer is basically agreeing to risk 5% of the purchase price and to agree to a HOA agreement that seems fairly limitless in potential liability/assessments, all for the chance to get a good price on a condo project that appears to have failed as a revenue model. The more I think about it, the more I seem to be talking myself out of it.

But, I do like the units and the location is convenient. This may be a day of the auction call for me on whether it is a worthwhile venture, even at a discounted price.

Will

December 2, 2009, 4:35 pm

I think your insight is probably correct about this auction. And if it

goes badly I think it's likely that there will be a foreclosure which

probably leads to another better organized auction or good buying

opportunity anyway. Dry powder rules in 2010.

December 2, 2009, 8:29 pm

For the sake of clarity about the West End, I do think that there is a lease restriction in the by-laws. I didn't read them closely, but it appears that you cannot lease until the building is 100% sold (Section 12.1).

December 2, 2009, 9:38 pm

Good point. Yes, there can be no leasing for some time at the West End and there are also onerous right of first refusal conditions in that same section of the bylaws. Absent a release from these conditions this could make it very difficult for owners to sell their units and, oddly, owners are also agreeing to be assessed for their share of any unit purchase that the HOA decides it may want to make. I wonder how many prospective bidders will even read these provisions.

December 2, 2009, 10:29 pm

I assume that most investors (who know what they are doing) will read them. I do think that a lot of first time purchasers (like myself) will not.

All in all, given the fairly creative/strange/restrictive/open to abuse by-laws, the strange financing arrangements (Compass won't do loan commitments, only pre-qualifications – which means bidders are risking 5% of the purchase price with no way to assure financing), and the strange lack of information flow on reserves and which units are absolute, I am getting pretty nervous about bidding at this auction.

Any potential buyer is basically agreeing to risk 5% of the purchase price and to agree to a HOA agreement that seems fairly limitless in potential liability/assessments, all for the chance to get a good price on a condo project that appears to have failed as a revenue model. The more I think about it, the more I seem to be talking myself out of it.

But, I do like the units and the location is convenient. This may be a day of the auction call for me on whether it is a worthwhile venture, even at a discounted price.

Will

December 2, 2009, 10:35 pm

I think your insight is probably correct about this auction. And if it

goes badly I think it's likely that there will be a foreclosure which

probably leads to another better organized auction or good buying

opportunity anyway. Dry powder rules in 2010.

January 13, 2010, 11:58 pm

April 4, 2011, 10:53 am

This site has lots of extremely useful information on it. Thank you for sharing it with me!