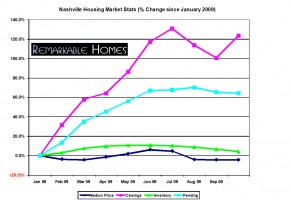

The Middle Tennessee MLS (Realtracs) just released October 2009 stats. The adjacent graph and analysis are based upon the residential single family homes and condos market only. As you may recall in September, the number of closings and pending transactions took a hit, but inventory did burn off. Did October begin a trend of real estate market deterioration or is Nashville back on track?

Total Inventory (Good, Getting Better)

Inventory levels continued to decrease in October, down 2.4 percent from September, and now just slightly up 4.02 percent since January. There were a total of 16,575 active homes and condos in Nashville last month, compared to October 2008 when there were 17,169 on the market, a respectable year over year drop of 3.58 percent (I am aware that shadow inventory does exist, but am not factoring into these ‘hard’ MLS numbers).

Pending Sales (Very Good, Holding)

Pending sales in Nashville are up rather significantly in 2009. Since January, pending sales have vaulted 60.87 percent higher. Also, for the third consecutive month, total pending sales are higher than their levels a year ago. October 2009 levels are a full 40 percent higher than October 2008 when 1,504 total properties were pending. This is very, very encouraging news as it represents a new 2009 benchmark high in addition to bucking our usual seasonal dip (thank you first time homebuyer tax credit).

Closed Sales (Great, Rebounding)

After 2 straight months of falling closings, total closings rebounded rather significantly as buyers took advantage of their Federal tax credit. Since January closings have risen 123.48 percent. This number represents an 11.34 percent gain over September. Compared to the same period in 2008, year over year closings have now increased an eye raising 19.61 percent when 1,660 properties closed. The gain in closings can be directly attributed to the first time home buyers credit. That being said, just 3 months ago the Nashville market was 9.07 percent worse than the recorded closings in 2008, now we are 19.61 percent better…I would say that a 28.68 percent year over year turnaround over 3 months is pretty outstanding.

Median Prices (Low, Stable)

After 2 months of accelerated decreases, October pricing appears to have stabilized at $157,761. This median price represents a 0.05 percent decrease from September’s median price of $157,863. A portion of this drop can be attributed to first time home buyers and distressed foreclosures, but as more primary residence buyers find higher quality distressed property, the prices have stabilized. The median price is down 6.41 percent compared to October 2008 when the median price was $167,870.

Months of Inventory (Decent, Getting Better)

Based on October’s closed sales, it would take 8.03 months to sell all existing inventory. Based on pending sales (contracts accepted but not closed yet) it would only take 7.87 months. Our absorption rate has been steadily increasing in every month of 2009 except for September and for the first time in 2009, we are better off than 2008. In fact, in October 2008, Nashville had 10.32 months of inventory on the market compared with 8.03 in 2009.

Just as I predicted in August, every single indicator on the graph above is better than 2008 except for the median price which is only running 6.41 percent behind the 2008 benchmark. As I also predicted in August, median prices will to continue to bottom feed for the remainder of the year and probably well into 2010 due to the combination of first time buyers and less $1 mil+ transactions.

Prediction

I am beginning to see light at the end of the tunnel when comparing year over year numbers. I realize that it is way too early to call, but I am going to do it anyway: The Nashville real estate market officially bottomed out in late August/early September 2009. Bold, I know. But, with the federal tax credit having been not only extended, but expanded coupled with the treasury’s willingness to keep mortgage rates artificially low, it’s hard to see a regression in the short term. Perhaps this is a dead cat bounce until May or June 2010, but it will certainly represent a period of turnaround despite lowering prices (we still have not given back all of the price gains since January 2006, but we should by the beginning of 2010).

7 Data Backed Predictions for the 2026 Real Estate Market

7 Data Backed Predictions for the 2026 Real Estate Market

Short Term Rental Laws in Middle Tennessee

Short Term Rental Laws in Middle Tennessee

November 12, 2009, 8:56 am

November 12, 2009, 4:51 pm

This shocker today (11/12/2009) in the online Nashville Business Journal:

“Even more condo units will soon be sold at auction.

Forty-five units at John Coleman Hayes' The West End Luxury Condominiums will be sold at auction Dec. 5.

The condo tower, located at West End and 31st Avenue, features 72 units. Since opening in April 2008, five have sold.

Current list prices for the units range from $385,000 to $948,000. The auction will include five one-bedroom units, 25 two-bedroom units and 15 three-bedroom units.

The average square footage of offered units is 2,100 square feet.”

This ought to result in even lower bids at Terrazzo's auction on 11/21/2009, don't you think? With 75 high-quality condos being auctioned over the next three weeks, who in their right mind would pay what the developers of Velocity and Icon are currently charging? It looks like buyers who bought early on into these projects, as well as Terrazzo, got burned badly. Five sales in 18 months is simply astounding.

November 12, 2009, 8:08 pm

Doesnt sound like its the same market as the Terrazzo with prices like that. The LOW was $385k? No wonder they can't sell them.

November 12, 2009, 8:58 pm

When the Terrazzo auction was first announced, the Tennessean reported an investor had bought a one-bedroom unit, preconstruction, for $373,000. (Actually, the paper reported this investor had bought three units, but the prices of the other two units were not disclosed.) The West End units are far larger and more traditional than Terrazzo (and, depending on your taste, more upscale), but your point is well taken: the prices developers have been charging, and in some cases getting, far exceed the FMV of these properties.

November 12, 2009, 10:51 pm

This shocker today (11/12/2009) in the online Nashville Business Journal:

“Even more condo units will soon be sold at auction.

Forty-five units at John Coleman Hayes' The West End Luxury Condominiums will be sold at auction Dec. 5.

The condo tower, located at West End and 31st Avenue, features 72 units. Since opening in April 2008, five have sold.

Current list prices for the units range from $385,000 to $948,000. The auction will include five one-bedroom units, 25 two-bedroom units and 15 three-bedroom units.

The average square footage of offered units is 2,100 square feet.”

This ought to result in even lower bids at Terrazzo's auction on 11/21/2009, don't you think? With 75 high-quality condos being auctioned over the next three weeks, who in their right mind would pay what the developers of Velocity and Icon are currently charging? It looks like buyers who bought early on into these projects, as well as Terrazzo, got burned badly. Five sales in 18 months is simply astounding.

November 13, 2009, 2:08 am

Doesnt sound like its the same market as the Terrazzo with prices like that. The LOW was $385k? No wonder they can't sell them.

November 13, 2009, 2:58 am

When the Terrazzo auction was first announced, the Tennessean reported an investor had bought a one-bedroom unit, preconstruction, for $373,000. (Actually, the paper reported this investor had bought three units, but the prices of the other two units were not disclosed.) The West End units are far larger and more traditional than Terrazzo (and, depending on your taste, more upscale), but your point is well taken: the prices developers have been charging, and in some cases getting, far exceed the FMV of these properties.

November 16, 2009, 6:19 pm

December 1, 2009, 1:26 pm

May 5, 2010, 2:19 pm